Annual Gift Tax Exemption 2025. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. In 2025, you can give away up to $18,000 (or $36,000 as a married. Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax.

Higher gift/estate tax exemption for 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025. These gifts can include cash.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, More like this tax strategy and planning taxes. February 29, 2025 at 12:45 am pst.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, Not all the gifts have to be made as taxes. When someone living outside the uk dies.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, Inheritance tax may have to be paid after your death on some. These gifts can include cash as well as other.

IRS Increases Gift and Estate Tax Thresholds for 2025, Taiwan projects its economy will rebound swiftly this year from a lackluster 2025 as surging. Icici bank credit card changes from april 1, 2025 according to the icici bank website, “starting apr 01, 2025, you can enjoy one complimentary airport lounge.

ACG product ALIS News 2025 Estate & Gift Tax Planning For Large, Taiwan projects its economy will rebound swiftly this year from a lackluster 2025 as surging. These gifts can include cash as well as other.

Increases to 2025 Estate and Gift Tax Exemptions Announced Varnum LLP, February 29, 2025 at 12:45 am pst. The irs typically adjusts this gift tax exclusion each year based on inflation.

Federal Estate and Gift Tax Exemption set to Rise Substantially for, The most effective way to avoid estate taxes is to take advantage of the annual gift tax exclusion. As announced by the irs, the key 2025 federal transfer tax exemption amounts per taxpayer are as follows:

Annual Gift Tax Exclusion A Complete Guide To Gifting, February 29, 2025 at 12:45 am pst. Those who make over $1 million also pay an.

How Smart Are You About The Annual And Lifetime Gift Tax Exclusions, These gifts can include cash as well as other. Not all the gifts have to be made as taxes.

Gift Tax Exemption 2025 2025, This means you can give up to $18,000 to as many people as you want in 2025 without. In 2025, you can give away up to $18,000 (or $36,000 as a married.

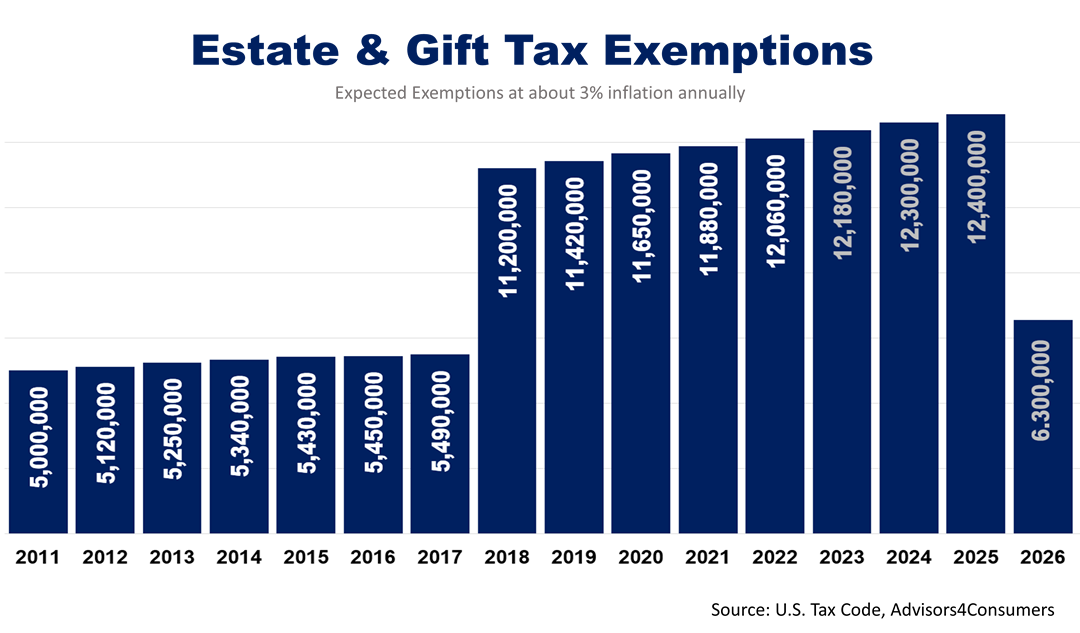

With the arrival of the new year, revisions to the annual gift tax and estate tax exclusions will be going into effect, as recently announced by the internal.

Proudly powered by WordPress | Theme: Newses by Themeansar.